Recommendations for social media strategies for Swiss companies and organizations

Constant change is in the nature of the social media landscape. One way to spot trends is to look at absolute user numbers on platforms. But in our market, it's more interesting to see how active users are to gauge a platform`s health and success, as idle accounts are an indication of how engaged users are. In this article, we compare platform usage numbers to their advertising reach for companies in Switzerland. We then use this information to make recommendations for social media strategies for Swiss companies and organizations.

A prominent tourism region in Switzerland approached our agency with a task: assess the relevance of their social media goals. They wanted to know whether their growth targets for followers, reach, and link clicks on various platforms were still feasible? For example one of their long-standing objectives was to enhance organic reach per Facebook post by 10% annually. But is this still relevant after a few years given the dynamic social media landscape?

We are interested in how many active users a platform has in Switzerland, and whether the number of global users is increasing or decreasing, as well as how much time they spend on a platform when content reaches them.

Let's compare Statista's global user forecasts1 with the advertising sector in Switzerland:

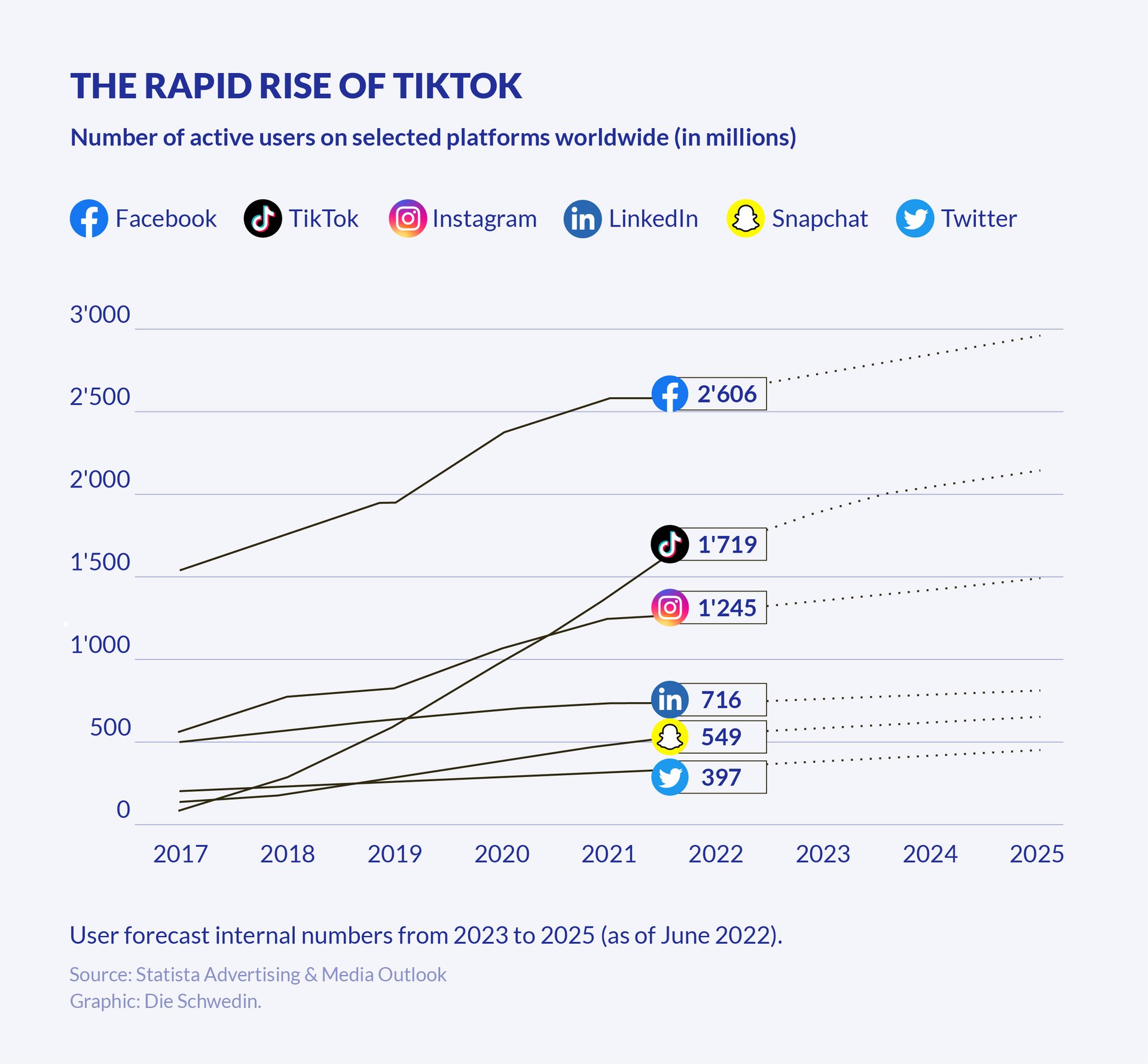

Global usage figures: TikTok is growing rapidly, and Facebook remains the largest platform

Global social media use continues to grow rapidly. In 2022, 4.6 billion people –about 60% of the world’s population– were active on social media. According to Statista’s forecasts, this number is set to reach almost 6 billion by 2027!

TikTok confirms that users swiftly embrace new offerings: the video-sharing platform gained an astonishing average of 340 million new active members per year between 2018 and 2022. TikTok overtook Instagram in user numbers in 2021 bolstered by the "digital boom" of the Covid pandemic,, making it stand out from its competitors with its extraordinary growth rate. However, Statista expects this growth to slow down (perhaps because a new hyped-up platform will emerge) and TikTok's user base will reach the 2 billion mark "only" in 2024.

Facebook remains the largest social network and will grow to nearly 3 billion users by 2025 despite a significant slowdown in growth in recent years.

Instagram ranks third and is expected to keep growing.

LinkedIn, Snapchat, and X all have lower growth rates. Statista's forecast for X (formerly Twitter) has been revised downward, with the number of Twitter users expected to drop from 362.4 million in 2021 to around 336 million in 2024 due to negative headlines about Twitter and Elon Musk.2

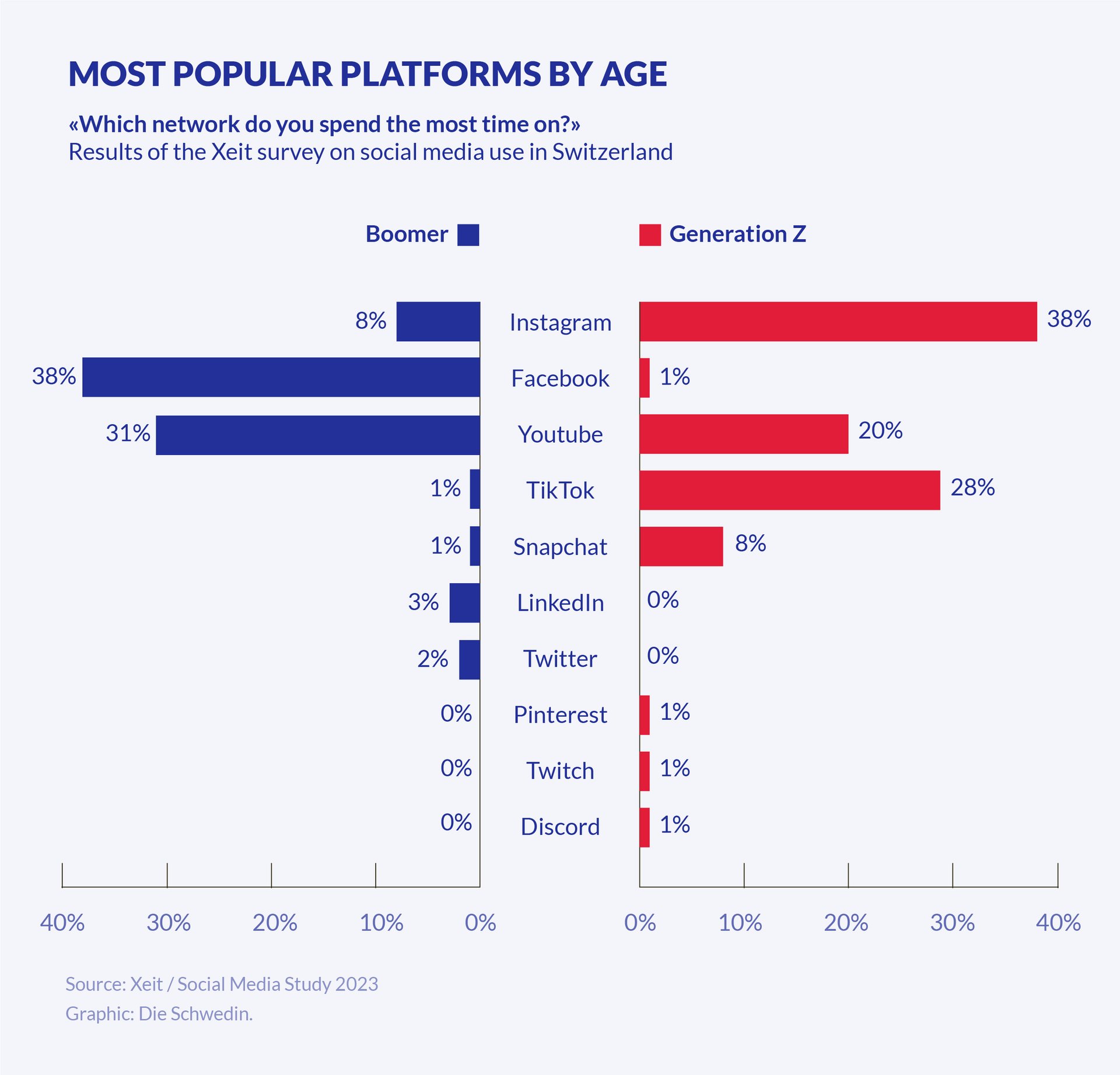

Swiss users on Facebook and Instagram most often

A new study by Xeit shows how different generations in Switzerland use social media. While nearly 40% of boomers (people born between 1946 and 1964) spend the most time on Facebook, only 1% of Gen Z (born between 1990 and 2015) use the platform more often than any other. The most-used platform for this audience is Instagram, ahead of TikTok.

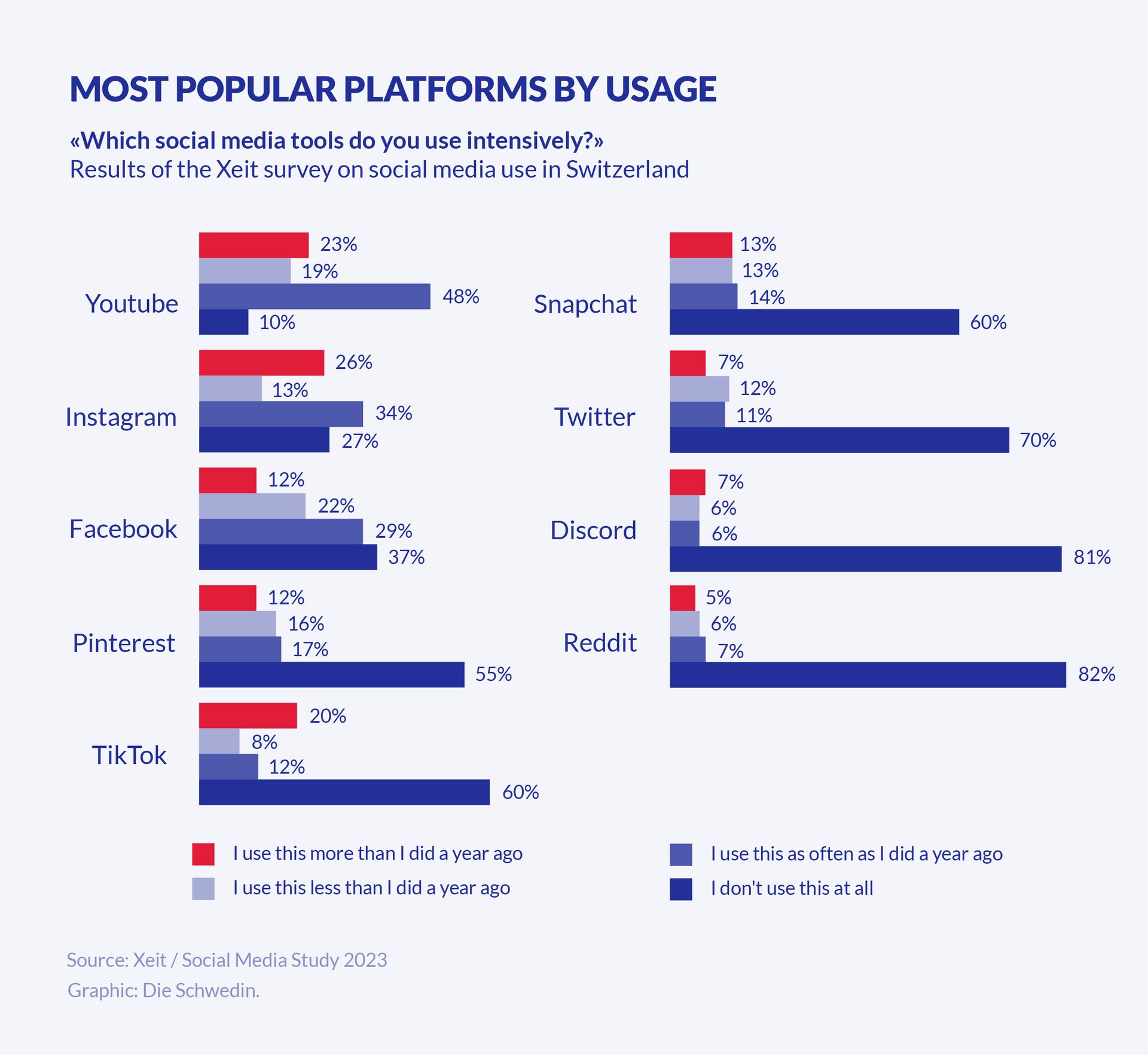

Social media usage has increased overall in the past year, especially on Instagram and TikTok, with the sharpest drop on Facebook. Despite all this, 63% of Swiss people still go on Facebook at least occasionally. Surprisingly, almost half of active users are aged between 24 and 44, while only a third are over 45.3 Facebook ranks third in terms of usage in Switzerland, behind YouTube (90%) and Instagram (73%).

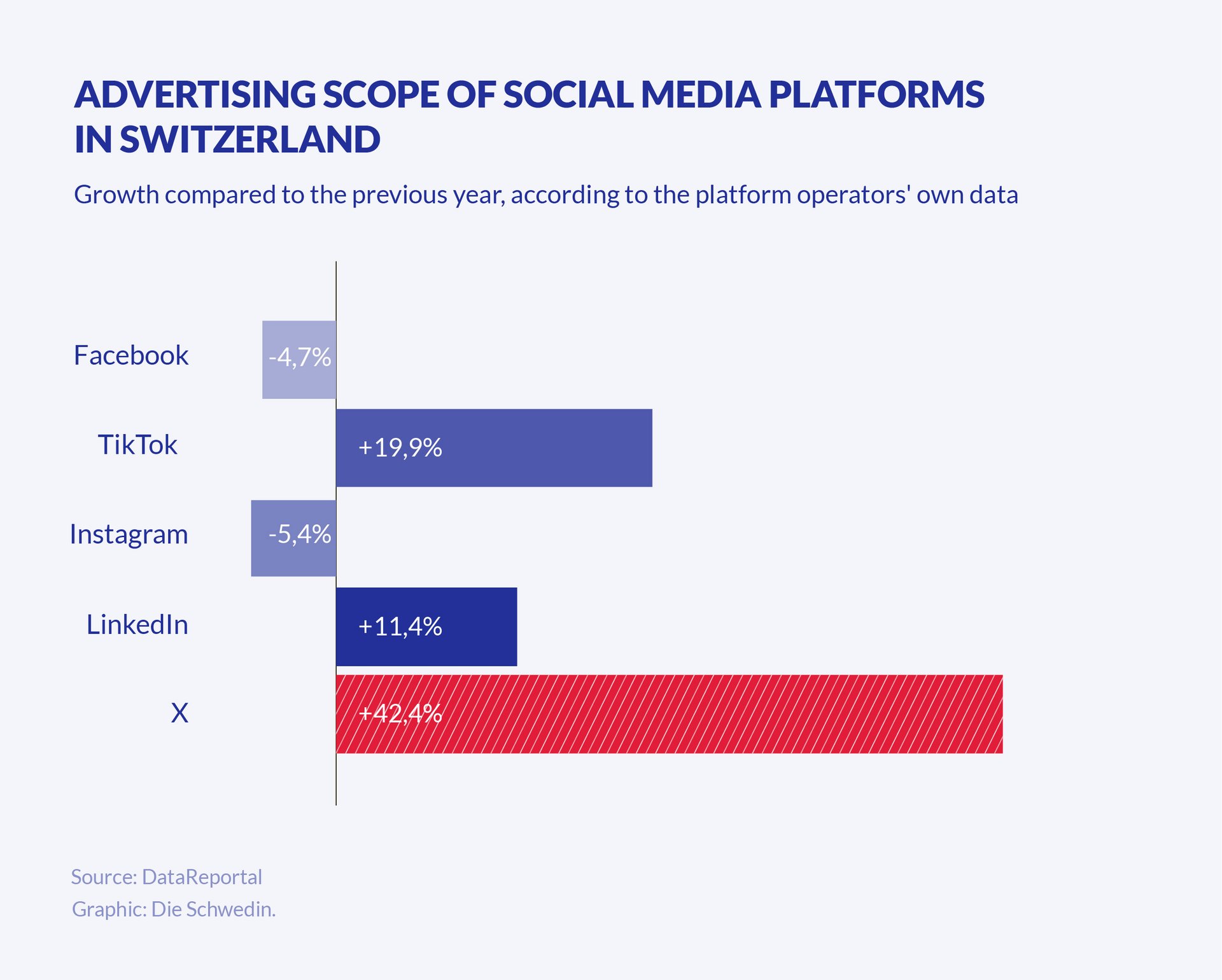

Advertising reach: TikTok expands reach, LinkedIn has the most active users

Advertising reach holds significant value in advertising, as it indicates the number of potential customers or members of a target group who have seen or may see an advertisement. We find it fascinating to examine the advertising reach of various platforms – the extent to which an ad campaign, ad, or message reaches individuals or households.

X – a tweetment for a declining bird

The biggest loser in terms of advertising reach is likely to be X. Although the platform announced last year4 its advertising reach in Switzerland was set to increase by around 42%, this is in the current climate highly unlikely. Although X itself does not report any current figures, according to Statista5, the platform recorded 14% fewer visitors worldwide than in the previous year.

This figure seems far more realistic to us than X's forecast, as both visible activity on the platform has decreased significantly and it is also known that a number of prominent Twitter users have withdrawn from X altogether, including journalists. Many formerly active Twitter fans have turned their backs on the platform since Elon Musk took over and made some questionable decisions (such as the paid blue tick or the lack of content moderation in the name of "freedom of speech"). According to media reports, X's advertising revenue has plummeted by more than half since Musk took over. The Süddeutsche headlines: "Project X has failed".

TikTok scores with youth

When we eliminate X, TikTok is the clear winner with the highest percentage of revenue growth. App developer ByteDance reported that TikTok's advertising reach in Switzerland grew by almost 20% (341,000 people) from 2022 to 2023 – a figure in line with anecdotal opinion. Most TikTok users:

- belong to generations Y and Z.

- two thirds are between 13 and 24 years old.

- 74% are female.

So if you want to reach young target groups, there's no getting around TikTok. In general, the platform is an exciting way to engage with new aesthetics. Short videos ranging from humorous to embarrassing are shared on TikTok, which are supplemented with music, filters and effects - companies can use the platform to experience trends live and help shape them. Anyone who can provide resources for this should therefore include this platform in their marketing mix. Youth culture has always influenced trends, fashion, language, music and behavior, and social media platforms like TikTok accelerate this process.

LinkedIn – an interesting option for ads

Despite lower growth rates, LinkedIn also scored positively for advertising coverage, activity on the platform, posts and engagement is all interesting for LinkedIn's advertising reach. Over the past few years, activity on the business platform has increased by around 20% annually, with an impressive 48% from 2020 to 2021.6 You'll have noticed this yourself when you're on LinkedIn: just a few years ago, most people only used LinkedIn to update their CVs from time to time or connect with someone they met at an event or through the job. Today, regular posting on LinkedIn is standard.

According to a recent analysis, LinkedIn has the most active users of all social media platforms in Switzerland!7 While LinkedIn does not provide data on user demographics in Switzerland, we can assume the figures are similar to those reported by Statista8 in Germany:

- Millennials and Gen X each account for 34% of users.

- Almost two-thirds were born between 1960 and 2000 and are aged between 23 and 63. Compared to other networks, LinkedIn users have the highest income.

- 25% of users have at least one university degree.

Facebook and Instagram lose out

Facebook and Instagram have lower advertising coverage compared to TikTok and LinkedIn and Meta’s two platforms losing around 5 percentage points each according to their own data. However, Instagram still has almost double the active users in Switzerland compared to TikTok9 and appeals to a broader demographic with three quarters of users aged between 18 and 45.10

Organic vs. Paid Reach: LinkedIn and TikTok on the Offense

Clients often ask us: why can`t we rely on organic reach alone? Why do we also have to budget for paid reach as well. We understand that companies of course want to reach their target groups spending the least amount of money possible on advertising. But if they use Meta's platforms Facebook and Instagram without paying for advertising, their reach will always be limited. Less than 10% of people who follow a company see their organic posts. Luckily, for the moment anyway, it's cheap to buy visibility on Meta. For just three francs, a company can reach around 1,000 more people in their target group.

TikTok and LinkedIn have taken a different approach: Organic content is distributed generously, and posts often reach far beyond a user’s own following. Creating content and building a following is worthwhile on these platforms even without an ad budget. How can that be worthwhile for these networks? After all, Meta earns a lot of money from advertising.

On both TikTok and LinkedIn, paid advertising is possible. On LinkedIn, for example, you can direct an ad or a post to specific professional groups, such as CEOs and CFOs in the construction industry, or to media professionals who are interested in climate change, and so on. If you want to use these specific targetings, you must dig deeper into your pockets. On average, these ad costs are around ten times higher than for Meta.

On TikTok, the cost of typical ads is not necessarily higher than on Meta but TikTok also offers unusual (and more expensive) formats such as the Brand Takeover Ad, which is shown fullscreen to users for a few seconds as soon as they open TikTok, which can generate enormous attention in a sought-after target group.

Conclusion

What do these new developments and insights mean for companies' social media strategies? Let's repeat what we said at the beginning of this article:

Companies must continually adjust their social media strategy to account for current trends and their target market’s user behaviour. To achieve this, they must first identify their target audience and regularly evaluate which platforms and features are best suited to reaching them.

The following picture emerges from our analysis:

- LinkedIn should be used actively – it has the largest number of active users in Switzerland and offers high visibility with promising target groups. We deem it an effective substitute for X for reaching media professionals. LinkedIn also offers interesting potential in the field of social ads thanks to its reliable knowledge of the users' profession, industry and employer.

- To reach younger audiences, choose between Instagram and TikTok. Instagram has more users than TikTok, with 3.5 million compared to just over 2 million, but TikTok is growing and appeals to a younger audience. Creating good content on TikTok is more challenging. Companies targeting young people should use both platforms. To experiment with new aesthetics and communication methods, consider adding TikTok to the mix. Those targeting the entire population with a limited budget can continue with only Instagram.

- Facebook continues to be a key platform in Switzerland for audiences over 24, although strategic goals for reach and community growth should be reduced. We continue to achieve great results with social ads on Facebook for older audiences. Especially when a target audience includes people with a lower level of education or outside of desk occupations, the use of time and money can make a lot of sense here.

It is important to remain flexible, adapt to new trends (but not follow every hype) and constantly redefine your company's goals concerning social media.

Do you need support in defining or reviewing your social media strategy?

Let us guide you through the social media jungle powered by our many years of experience, up-to-date knowledge and honed implementation skills!

1 https://www.statista.com/chart/28412/social-media-users-by-network-amo

2 https://de.statista.com/statistik/daten/studie/318483/umfrage/twitter-nutzerzahlen-weltweit-prognose/

3 https://de.statista.com/statistik/daten/studie/527632/umfrage/anteil-der-facebook-nutzer-in-der-schweiz-nach-geschlecht/

4 https://datareportal.com/reports/digital-2023-switzerland

5 https://de.statista.com/statistik/daten/studie/1021439/umfrage/anzahl-der-visits-pro-monat-von-twittercom/

6 https://www.futurebiz.de/artikel/linkedin-statistiken/

7 https://de.statista.com/statistik/daten/studie/520144/umfrage/nutzer-sozialer-netzwerke-in-der-schweiz/

8 https://www.statista.com/study/72707/social-media-linkedin-users-in-germany/

9 https://de.statista.com/statistik/daten/studie/520144/umfrage/nutzer-sozialer-netzwerke-in-der-schweiz/

10 https://de.statista.com/statistik/daten/studie/469909/umfrage/instagram-nutzer-in-der-schweiz-nach-altersgruppen-und-geschlecht/